Living cheaply doesn’t mean you have to eat plain rice for every meal or say goodbye to every little joy in life.

It just means being smarter with your money, cutting out the stuff that doesn’t matter, and finally breathing a little easier when the bills roll in.

I’m not here to tell you to stop drinking coffee or live off-grid. I’m here to SHARE real habits that make life cheaper without making it miserable.

Because let’s be honest—money stress is exhausting, and sometimes it feels like it just disappears into thin air, right?

What Is Cheap Living?

So… what does it actually mean to “live cheap”?

It’s not about being stingy, boring, or saying no to everything fun.

Cheap living is about spending less where it doesn’t matter—so you have more for the stuff that does.

For some people, that means shopping secondhand or cutting back on takeout.

For others, it’s moving into a smaller space or ditching subscriptions they forgot they had.

There’s no one-size-fits-all approach.

The cheapest way to live really depends on your lifestyle, your goals, and how much you’re willing to tweak your daily habits.

Here’s the thing: you don’t have to do it all at once. Even one small change—like planning your meals or using cash instead of cards—can make a difference fast.

Living cheaply just means being more intentional.

It’s not about doing without—it’s about doing more with what you already have.

And once you start seeing the results? It’s actually kind of addictive (in the best way).

How to Live Cheaply : Best Cheap Living Tips

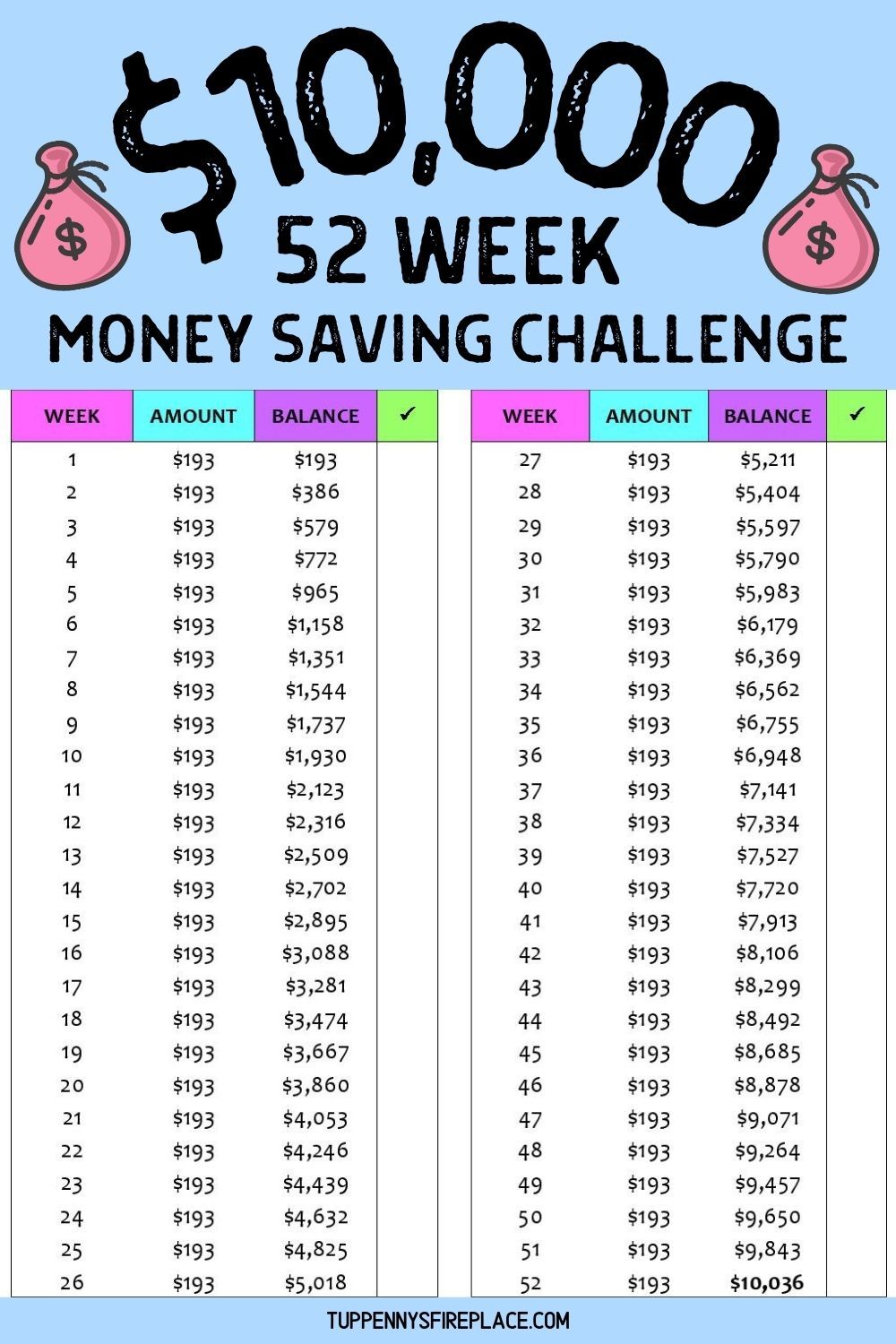

#Week #Money #Challenges

These aren’t vague ideas or recycled “skip your latte” advice.

These are real habits that make a noticeable difference—EASY enough to start today, and smart enough to stick with for the long haul.

1. Make a budget

I know, I know. You’ve heard this a hundred times.

But hear me out—a budget isn’t about restriction, it’s about clarity. When you know exactly where your money’s going, you stop guessing—and start saving.

You don’t need fancy spreadsheets or complicated apps either.

Just jot down your income, your bills, and what’s left. THAT’S where the magic happens.

2. Shop with a list and stick to it

Wandering the store “just to see” is a one-way ticket to spending $80 on things you didn’t need.

(Been there. Still have the random snacks to prove it.)

A list keeps you focused and out of the impulse aisle.

It’s one of the cheapest ways to live smarter—because you’re only buying what you actually planned for.

3. Cook more, eat out less

I’m not saying you have to become a chef overnight.

But if you can make a few go-to meals at home, you’ll save a serious chunk of cash over time.

Even something as simple as chili, pasta, or stir fry can save you $10–$20 every time you skip takeout.

Plus, leftovers are basically free food the next day. Just sayin’.

4. Buy generic when it makes sense

Name brands aren’t always better—sometimes they’re just better marketed.

Test out the store brand version of basics like pasta, cereal, or cleaning supplies.

You might be surprised how little difference you notice.

And hey, if you find something you really don’t like? You can always switch back.

But if you find 5 things that work just as well? That’s money saved without giving up anything.